Just to toss a little more information into this pool of ideals here is a CNBC article about a Trump plan.

The article mentions nothing about cutting spending. But does suggest that Trumps plan, at least as it is now, can't cover his tax cuts. Trump further asserts that his TARIFFS would result in new jobs for America because it would effectively force companies to 're-shore' factories from overseas or build new factories here. Maybe I missed it but I don't see that in the article. Further, the article says that it will raise prices that ultimately get passed to consumers, which can be true, but is negated by the idea that the tariffs would create job and move factories back to the US.

Former President Donald Trump’s tax reform ideas could offer total or partial income tax exemptions to roughly 93.2 million Americans, a meaningful chunk of the U.S. electorate, according to CNBC’s analysis of several estimates.

As part of his economic pitch to voters, Trump has floated a sweeping tax overhaul, including a slate of income tax breaks.

So far, the Republican presidential nominee has officially proposed eliminating income tax on tips and Social Security benefits, along with overtime pay. And last week, in an interview on the sports media site OutKick, Trump said he would consider tax exemptions for firefighters, police officers, military personnel and veterans.

These exemptions are part of Trump’s larger vision to transition away from the income tax system and replace it with the revenue he says would be generated by his hardline tariff proposals.

“In the old days when we were smart, when we were a smart country, in the 1890s and all, this is when the country was relatively the richest it ever was. It had all tariffs. It didn’t have an income tax,” Trump said at a sit-down with voters in New York on Friday for “Fox & Friends.” “Now we have income taxes, and we have people that are dying.”

Trump has pledged to impose a 20% universal tariff on all imports from all countries with a specific 60% rate for Chinese imports.

Tax experts reject the notion that tariff revenue could offset the losses incurred by eliminating income taxes.

“The math doesn’t work out,” Garrett Watson, a senior policy analyst at the nonpartisan Tax Foundation, told CNBC.

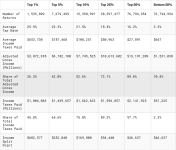

He said Trump’s tariffs would raise approximately $3.8 trillion over the next decade, far less than the roughly $33 trillion of estimated revenue generated by income taxes over the same period.

Given that tariffs are paid by U.S. importers and those costs have historically been passed on to consumers, Trump’s strategy appears to be based around a notion of replacing income tax revenue with a kind of invisible sales tax.

Tariffs, much like sales tax and other point-of-sale costs, tend to have the biggest impact on low-income consumers, for whom the amounts represent proportionately larger slices of their monthly budgets.

If implemented, Trump’s income tax exemptions could affect tens of millions of taxpayers.

Roughly 68 million Americans receive Social Security benefits each month, according to the Social Security Administration. And in 2023, about 4 millionworkers were in tipped jobs, according to an estimate from Yale University’s Budget Lab.

The U.S. Department of Veterans Affairs approximated in March 2023 that there were 18.6 million living veterans. There are 1.3 million active-duty military personnel, according to the Department of Defense. And there are 800,000 sworn law enforcement officers and roughly 500,000 paid firefighters.

Taken together, these reforms could leave about 93.2 million people off the hook for at least a portion, if not all, of their income taxes. . . .