There are a lot of pandemic era buyers who purchased vehicles at inflated prices and are now underwater on their car loans. Dealers had the upper hand during the times of parts/manufacturing shortages and consumers paid whatever was asked, often well above MSRP for the whatever scarce but available inventory existed. Things are different now. Economy is flat (at best) and interest rates are high, people are not buying, inventory on many brands is building rapidly. A couple popular brands like Honda and Toyota are in much better position than some of the other brands. But it could get ugly, except for people who have cash and want a car, it looks like it will be a "buyers market" over the next couple of months.

We have been watching the EV market inventory accumulate at the same time that prices have been slashed and dealers have still been refusing shipments from the manufacturers of those brands. Now we may see something similar for the ICE vehicle market too as consumers are cash strapped.

www.zerohedge.com

www.zerohedge.com

We have been watching the EV market inventory accumulate at the same time that prices have been slashed and dealers have still been refusing shipments from the manufacturers of those brands. Now we may see something similar for the ICE vehicle market too as consumers are cash strapped.

ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

"New Car Inventory Has Exploded Higher"

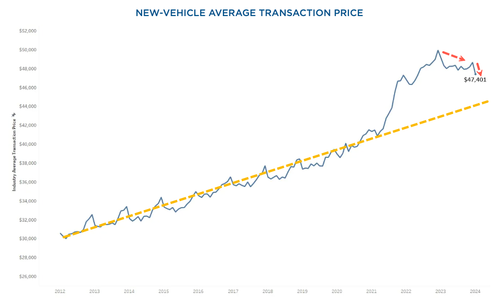

New car prices have been trending lower for about a year due to increased vehicle production and elevated interest rates that have crimped demand. As a result, inventories are swelling at dealerships nationwide, with expectations for new and used vehicle prices to continue sliding into the spring season.

A recent Kelley Blue Book report shows new car prices in January were down 3.5% compared with the same month one year ago. The average new car sold was $47,401.

"Prices have been trending downward for roughly six months now as automakers are sweetening deals to keep the sales flowing," Erin Keating, executive analyst for Cox Automotive, said in the report.

The downward pressure is mainly because new vehicle inventory has surged. As of January, it stood at 2.66 million units, a 49% jump in the past year, according to Cox data.

"With rates higher so far this year, the consumer has limited sense of urgency right now other than cash in hand," Jonathan Smoke, chief economist at Cox, said in a separate report.

In a post on X, Car Dealership Guy wrote that new car inventory in February "is rising fast."

February started with 80 days of new vehicle supply: The *highest* level since June 2020. Expect the deals to sweeten up for most brands.

Online auto buy/sell platform CarEdge's Zach Shefska noted on X: "For reference, new car inventory is up 195% over the past 30 months."

"New Car Inventory has EXPLODED higher," another X user said.

This is great news for prospective car buyers - but terrible news for the millions of folks who bought cars during the Covid mania and are underwater on their auto loans.