-

Please be sure to read the rules and adhere to them. Some banned members have complained that they are not spammers. But they spammed us. Some even tried to redirect our members to other forums. Duh. Be smart. Read the rules and adhere to them and we will all get along just fine. Cheers. :beer: Link to the rules: https://www.forumsforums.com/threads/forum-rules-info.2974/

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Housing Market about to Crash Again?

- Thread starter Melensdad

- Start date

Pretty good analogy of the situationthe 'Obama housing crash' was caused by the admin demanding banks write mortgages to anyone who could sign their name.

those buyers could not afford the houses the bought, they defaulted, houses went into foreclosure, got sold off dirt cheap because the banks wanted them off their books.

the couple across the street, for example. he was a not high level state employee, she did not work/earn. they sold their high $$ house in MD, bought here. he did _three_ re-fi's using the cashed out 'equity' to pay the first and second and third mortgages . . . until the money ran out. the house foreclosed, the bank(s) sold it off some $150k under value, just to get rid of it.

not sure we currently have a 'crash' - it more like prices are inflating, interest rates are going up, people can't afford the payments and banks are no longer writing mortgages to people who have no means to pay it back.

I don't recall a housing crash during Obama. I may have been too focused watching him ruin our Healthcare system and the Justice department.the 'Obama housing crash' was caused by the admin demanding banks write mortgages to anyone who could sign their name.

those buyers could not afford the houses the bought, they defaulted, houses went into foreclosure, got sold off dirt cheap because the banks wanted them off their books.

the couple across the street, for example. he was a not high level state employee, she did not work/earn. they sold their high $$ house in MD, bought here. he did _three_ re-fi's using the cashed out 'equity' to pay the first and second and third mortgages . . . until the money ran out. the house foreclosed, the bank(s) sold it off some $150k under value, just to get rid of it.

not sure we currently have a 'crash' - it more like prices are inflating, interest rates are going up, people can't afford the payments and banks are no longer writing mortgages to people who have no means to pay it back.

I believe the great crash to which you are referring happed during the Bush 43 administration. Not because of his policies but that of the Fannie Mae.

There was a big housing crash in 2008, I bought my home that year. it wasn't until 2018 that it was worth what I paid in 2007I don't recall a housing crash during Obama. I may have been too focused watching him ruin our Healthcare system and the Justice department.

I believe the great crash to which you are referring happed during the Bush 43 administration. Not because of his policies but that of the Fannie Mae.

And here is the crash, as predicted by many.

Full stories are at the links.

But clearly the market is in the tank.

There may still be some local hotspots in some regions but the market is clearly dropping fast.

From ZERO HEDGE:

www.zerohedge.com

www.zerohedge.com

www.marketwatch.com

www.marketwatch.com

CNBC reports:

www.cnbc.com

www.cnbc.com

As the U.S. housing market cools, feverish competition for homes in the past couple of years has left 72% having regrets about their home purchases, according to a recent survey from Clever Real Estate.

The number-one reason for the buyer’s remorse: 30% of respondents said they spent too much money.

The second most common regret was rushing the home-buying process, with 30% saying their purchase decision was rushed and 26% indicating they bought too quickly.

Full stories are at the links.

But clearly the market is in the tank.

There may still be some local hotspots in some regions but the market is clearly dropping fast.

From ZERO HEDGE:

US New Home Sales Crashed In July, Lowest SAAR Since Jan 2016 | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

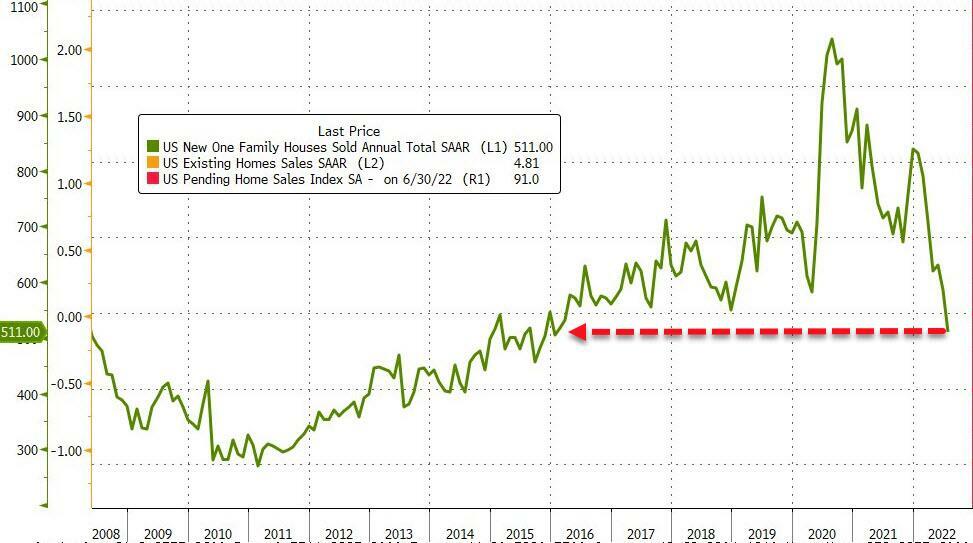

US New Home Sales Crashed In July, Lowest SAAR Since Jan 2016

US new home sales were expected to slide once again July but the 12.6% MoM crash was shocking (vs -2.5% exp). This pushed new home sales down 29.6% YoY

Source: Bloomberg

This is the 6th monthly drop in new home sales in the last 7 months (with come notable downward revisions too).

This is the lowest SAAR for new home sales since Jan 2016

Source: Bloomberg

Supply of new homes is soaring, now at 10.9 months vs 9.2 in the prior month... That is the highest supply since March 2009...

Source: Bloomberg

And from MARKET WATCH:

U.S. house values fell for the first time since 2012, Zillow says. Sellers and buyers are facing a very different housing market to 2020.

Industry experts say housing is in a recession. But this is very different from 2008.

U.S. house values fell for the first time since 2012, Zillow says. Sellers and buyers are facing a very different housing market to 2020.

Industry experts say housing is in a recession. But this is very different from 2008

Zillow revised its forecast for the growth in home values to 2.4% through the end of July 2023. The current rate of growth is 16%.

The housing market isn’t crashing, but it’s definitely feeling the burn.

After two frenzied years, home buying is cooling off as mortgage rates rise. Some experts in the field are calling it a “housing recession.”

U.S. home values fell in July by 0.1%, compared to the month before, a new Zillow report said.

While deceleration in home-price growth is typical for this time of the year, Zillow noted, the small decline is the first monthly dip since 2012.

The typical U.S. home value fell by $366 in July, and is now $357,107, as measured by the Zillow Home Value Index.

CNBC reports:

72% of recent homebuyers have regrets about their purchases. As the market cools, these steps can help you avoid disappointment

The hot seller's market in recent years prompted buyers to go above and beyond to seal the deals on their prospective homes, a recent survey finds.

72% of recent homebuyers have regrets about their purchases. As the market cools

As the U.S. housing market cools, feverish competition for homes in the past couple of years has left 72% having regrets about their home purchases, according to a recent survey from Clever Real Estate.

The number-one reason for the buyer’s remorse: 30% of respondents said they spent too much money.

The second most common regret was rushing the home-buying process, with 30% saying their purchase decision was rushed and 26% indicating they bought too quickly.

And thats the way it will go, until inflation is reduced. When material and labor costs keep rising its hard for anything to lose value, there is still a housing shortage, but the prices and new interest rates have priced many from the market. But I am sure Blackrock and Vanguard are still buying them up at a feverish pace.

If you buy a house and plan on using it as your home AND you lose your job, OR get transferred, OR divorced OR your plans are forced to change, OR the neighbors are jerks, OR the entire neighborhood goes into decline OR . . .If you buy a house and plan on using it as your home you will not be losing money.

If you buy a house as an investment you can lose as quickly as you can gain.

There was a big housing crash in 2008, I bought my home that year. it wasn't until 2018 that it was worth what I paid in 2007

Both Fannie may failures and the crash of 2008 were under Bush 43.

Obama wasn't President until 2009. Jus' sayin'

I didn't mention Obama, but as long as we are talking about democrats. the bubble and crash was caused by forcing the banks to loan to folks that couldn't pay it back. " Every American should own a home " I believe that was a Bush gift to the American people. Another progressive. Any progressive be it D or R are the same.Both Fannie may failures and the crash of 2008 were under Bush 43.

Obama wasn't President until 2009. Jus' sayin'

Before buying a house you should look at your own future and decide if you are going to have a job, or get transferred or divorced. Before buying a house you should take a look at the neighborhood. Sometimes people do not look past the end of their nose before jumping into something.If you buy a house and plan on using it as your home AND you lose your job, OR get transferred, OR divorced OR your plans are forced to change, OR the neighbors are jerks, OR the entire neighborhood goes into decline OR . . .

Historically that is how generational wealth is built. Not only is it your home, its the largest purchase/investment most folks make in there lifetime.If you buy a house and plan on using it as your home you will not be losing money.

If you buy a house as an investment you can lose as quickly as you can gain.

chowderman

Well-known member

Before buying a house you should look at your own future and decide if you are going to have a job, or get transferred or divorced. Before buying a house you should take a look at the neighborhood. Sometimes people do not look past the end of their nose before jumping into something.

a lot of companies now consider employees to be disposable assets.

they hire people when things pick up, when the quarterly profits go down they fire people.

the old rules of work hard, collect your gold watch and 20 year pension simply no longer apply.

But if you are buying it for an investment there are many ways to make the money faster. The money you are paying for a home is money saved since you are not paying rent. If you would deduct the money you would have paid in rent from what your house is worth it wouldn't seem like a good investment.Historically that is how generational wealth is built. Not only is it your home, its the largest purchase/investment most folks make in there lifetime.

Last edited:

Depends on what you do for a living. There are many companies that hire people for long term. Quite a few places I have worked there are people there who have fifty plus years working at the same place. Some places the people working there have not ever had any other job in their life and they are retiring.a lot of companies now consider employees to be disposable assets.

they hire people when things pick up, when the quarterly profits go down they fire people.

the old rules of work hard, collect your gold watch and 20 year pension simply no longer apply.

Not quite true. Right now, it is very difficult to find applicants, much less qualified applicants. many companies are holding on to people that have skills and training because, when business picks up, new ones are scarce. Sometimes keeping marginal employees. I know this on a personal basis.a lot of companies now consider employees to be disposable assets.

they hire people when things pick up, when the quarterly profits go down they fire people.

the old rules of work hard, collect your gold watch and 20 year pension simply no longer apply.

Whether a company has invested in machinery, technologies or people, the investment is the same. A trucking company would not scrap off old members of its fleet when new trucks are not available. Same with drivers. And that is a true situation today.

As forthe gold watch, old people are all I put on the payroll anymore. Young ones have no intention of staying for any long term, much less the gold watch. Don't blame the company for that.

Right now, I have five old men who show up every day. The youngsters, males and females, come and go.

historically property increases around 3% year over on average , 1,000,000.00 home = 300,000.00 increase in ten years, when the property is paid for, its still increasing in value and you are not paying rent anymore, so your kids then grandkids would be setting pretty. Notice I said generational wealth. Imagine if you were on the receiving end of a oceanfront property bought by your grandfather in San Diego. Also there are tax incentives. A second property could be rented for additional income. I sold a home in 2018 for $385,000.00 that I paid $134,000.00 in 1997. I lived there for a while then rented it out and bought the home I am in. The renter Paid the payment on the home, I got the $385,000.00But if you are buying it for an investment there are many ways to make the money faster. The money you are paying for a home is money saved since you are not paying rent. If you would deduct the money you would have paid in rent from what your house is worth it wouldn't seem like a good investment.

That is not the normal, most change gobs even industries several times in there working career. if you were operating a Hydro at Hoover Dam or Lake Powell you would likely be one of those.I went to work in a hydro electric plant many years ago. Four people who were working there went to work there when they were seventeen years old. That was their first job. All four worked there until they were seventy years old.

Im the old man that shows up everyday at my shop.Not quite true. Right now, it is very difficult to find applicants, much less qualified applicants. many companies are holding on to people that have skills and training because, when business picks up, new ones are scarce. Sometimes keeping marginal employees. I know this on a personal basis.

Whether a company has invested in machinery, technologies or people, the investment is the same. A trucking company would not scrap off old members of its fleet when new trucks are not available. Same with drivers. And that is a true situation today.

As forthe gold watch, old people are all I put on the payroll anymore. Young ones have no intention of staying for any long term, much less the gold watch. Don't blame the company for that.

Right now, I have five old men who show up every day. The youngsters, males and females, come and go.

UberBastid

Well-known member

Same here.Im the old man that shows up everyday at my shop.

Just had my 69th BD last week.

I bet you show up ON TIME.

Hair combed, teeth brushed.

Sober and awake and ready to work.

Damned scarce these days.

And now the institutional buyers are halting their home purchases. Just another sign that the housing bubble is going to, or perhaps already has, burst. It might be time for me to again resume buying and flipping house in a few months. I got out when the bidding wars started and people were bidding above asking prices in marginal areas. Looks like sanity is coming back. And coming back quickly.

www.zerohedge.com

www.zerohedge.com

The Other Shoe Drops: Blackstone Landlord Halts Home Purchases In 38 Cities As Market Crashes | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Bloomberg reported that Home Partners of America, the single-family landlord owned by Blackstone, the largest residential and commercial landlord in the US, will stop buying homes in 38 US cities, becoming the latest institutional investor to back away from an overheated housing market.

The company, which was acquired by Blackstone in June 2021 for $6 billion, told customers that as of Sept. 1, it is pausing applications and property submissions in Boise, Idaho; Fresno, California; Memphis, Tennessee, and 25 other areas. The company will go on hiatus in 10 additional cities on Oct. 1 (incidentally, Boise, ID is the city which saw explosive price increases during the covid pandemic, and has since then seen an unprecedented plunge with Redfin reporting that a record 70% of home sellers had dropped their asking price in July). . .

. . . Home Partners isn’t the first Wall Street institutional investor to back away from the US housing market, which reached a frenzied bubble during the first half of the year, a bubble which has since popped with both new and existing home sales collapsing at near record rates. . .

UberBastid

Well-known member

Just a personal, anecdotal observation ... with an associated theory.And now the institutional buyers are halting their home purchases. Just another sign that the housing bubble is going to, or perhaps already has, burst.

I am currently consulting with a large, residential property investor. He currently holds four units and above ... up to 58 units for large residential properties in California and Oregon. I won't say how many, or his name as you would recognize it, but his holdings are substantial.

These are definitely 'up scale' apartments with many amenities. Groomed garden grounds, pool, spa.

We consider raising rents every January and send out notices in February. California law won't allow us to raise rents more than 10% per annum, no matter what.

So, we're looking at raising rents on a 2/1 by $140 a month - after a $130 raise just last year.

There is a meeting. About six of us. Accountants. Brokers. Bankers. Economists.

El Heffe says, "What is our vacancy rate now? What was it this time last year?"

That was my department so I answered, "92% ... and 99%."

"So, our vacancy has gone up sharply. Why?"

Since I am in charge of overseeing the filling of vacancies, and the local apartment managers report to me, I answer "Most of the people moving out are leaving the state. They are young, upwardly mobile - and will chase the economy in a heartbeat."

Boss man says, "Will raising the rent on this demographic make them move out?"

"Not in my opinion. A hundred bux doesn't mean that much to them. The quality of life has declined noticeable in California, business is leaving -- young people don't want to live like that."

He nodded thoughtfully and said: "I suspected that myself. Raise the rent to the limit."

I believe that California is phucked ... in triplicate

If I wasn't as old as I am, I would bail.

But, I think that I'll be ok for the rest of MY run (which won't be long).

I feel the same way, when my son takes over the business, I may just do that. Some very nice properties right over the mountain in Minden, Gardenerville area of Nevada. Is also 1/2 way to the cabin. Prices are about the same as where I am now, It snows there a little in the winter, but I'm ok with that and its also cooler in the summer. As productive folks are replaced here in Ca. with useless eaters, the taxes will continue to rise along with fuel, food and everything else here.Just a personal, anecdotal observation ... with an associated theory.

I am currently consulting with a large, residential property investor. He currently holds four units and above ... up to 58 units for large residential properties in California and Oregon. I won't say how many, or his name as you would recognize it, but his holdings are substantial.

These are definitely 'up scale' apartments with many amenities. Groomed garden grounds, pool, spa.

We consider raising rents every January and send out notices in February. California law won't allow us to raise rents more than 10% per annum, no matter what.

So, we're looking at raising rents on a 2/1 by $140 a month - after a $130 raise just last year.

There is a meeting. About six of us. Accountants. Brokers. Bankers. Economists.

El Heffe says, "What is our vacancy rate now? What was it this time last year?"

That was my department so I answered, "92% ... and 99%."

"So, our vacancy has gone up sharply. Why?"

Since I am in charge of overseeing the filling of vacancies, and the local apartment managers report to me, I answer "Most of the people moving out are leaving the state. They are young, upwardly mobile - and will chase the economy in a heartbeat."

Boss man says, "Will raising the rent on this demographic make them move out?"

"Not in my opinion. A hundred bux doesn't mean that much to them. The quality of life has declined noticeable in California, business is leaving -- young people don't want to live like that."

He nodded thoughtfully and said: "I suspected that myself. Raise the rent to the limit."

I believe that California is phucked ... in triplicate

If I wasn't as old as I am, I would bail.

But, I think that I'll be ok for the rest of MY run (which won't be long).