Seems legit for a state to borrow, on long term bonds, for things like building a hydroelectric damn, or other infrastructure projects. But borrowing money for annual budgets, for pensions, etc seems like a recipe for fiscal disaster.

reason.org

reason.org

My state (Indiana) is ranked 30th, with $41 Billion in debt. The debt includes local municipalities, school districts, states and counties. On a Per Capita basis, Indiana is actually ranked 49th, with only a bit over $6000 in debt per citizen. Many states have debts, on a Per Capita basis that exceed $20,000 per resident.

Click on the link above to see your state in the list.

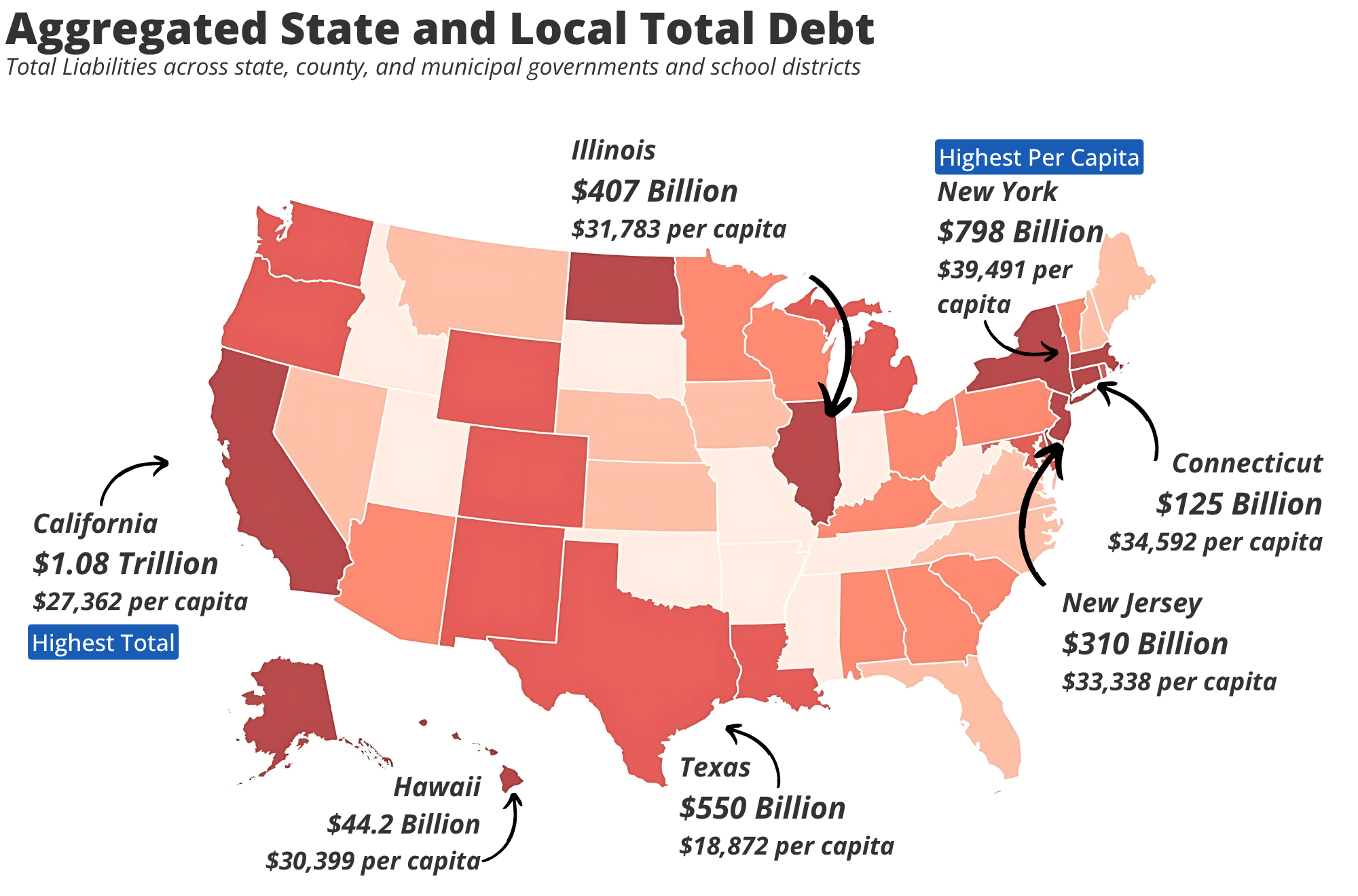

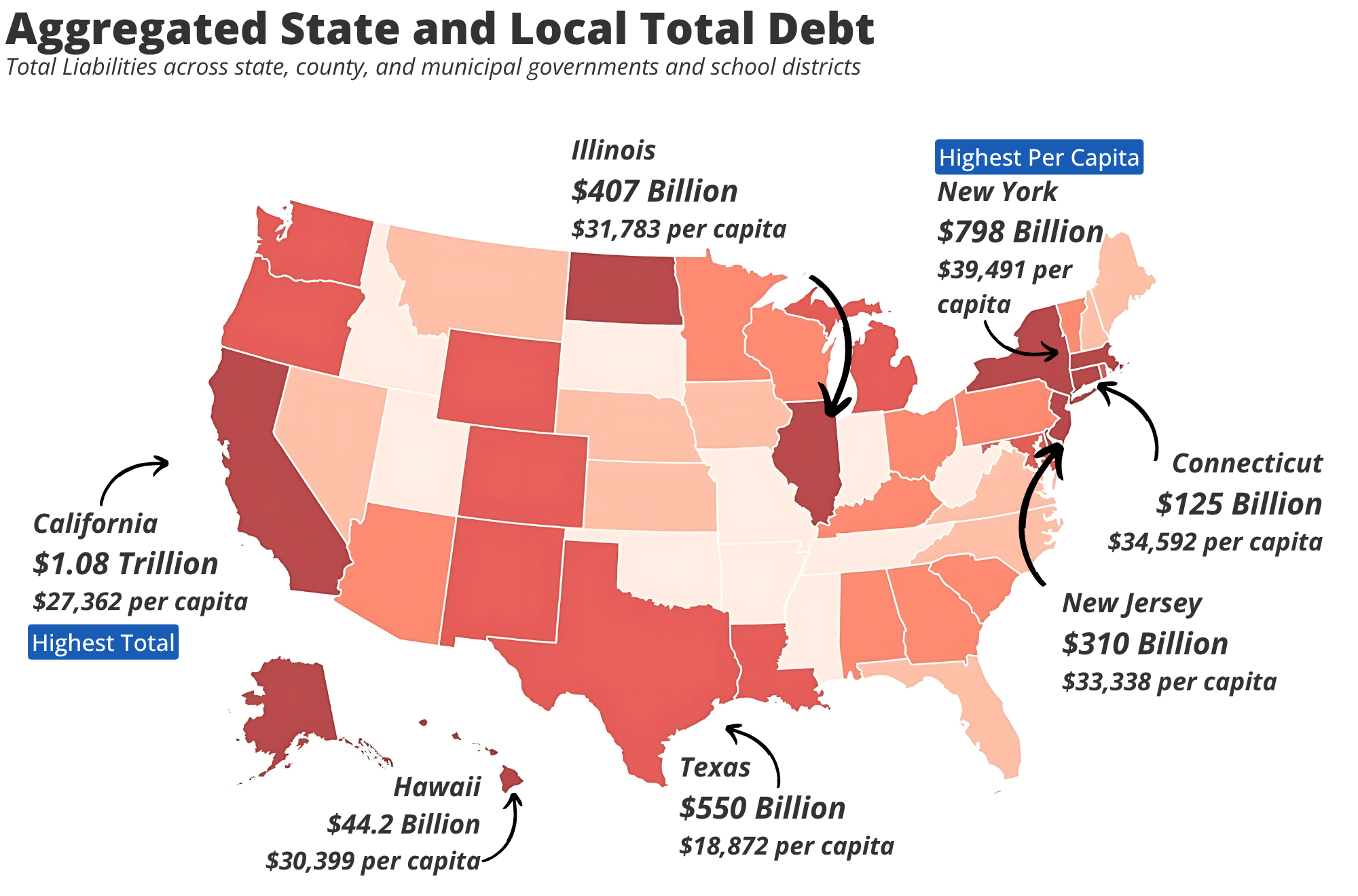

Report: State and local governments have $6.1 trillion in debt

State and local debt is over $100 billion in 16 states and exceeds $50 billion in 27 states. California’s state and local governments have over $1 trillion in debt.

My state (Indiana) is ranked 30th, with $41 Billion in debt. The debt includes local municipalities, school districts, states and counties. On a Per Capita basis, Indiana is actually ranked 49th, with only a bit over $6000 in debt per citizen. Many states have debts, on a Per Capita basis that exceed $20,000 per resident.

Click on the link above to see your state in the list.

Report: State and local governments have $6.1 trillion in debt

State and local debt is over $100 billion in 16 states and exceeds $50 billion in 27 states. California’s state and local governments have over $1 trillion in debt.

October 23, 2025

State and local governments had $6.1 trillion in debt at the end of 2023, a new Reason Foundation analysis finds. On a per capita basis, state and local debt amounts to approximately $18,400 per American. This state and local debt is in addition to the $38 trillion national debt.

Of the $6.1 trillion in state and local debt, $2.66 trillion is held by state governments, $1.4 trillion by municipalities, $1.27 trillion by school districts, and $757 billion by counties.

Reason Foundation’s State and Local Government Finance Report finds that $1 trillion is owed by California’s state and local governments, most in the country.

New York’s state and local debt is the second-highest in the nation, at $798 billion, followed by Texas’s $550 billion in state and local debt, Illinois’s $407 billion, New Jersey’s $310 billion, and Florida’s $242 billion.

Additionally, Massachusetts, Pennsylvania, Ohio, Washington, Michigan, Georgia, Maryland, Connecticut, North Carolina, and Colorado each have more than $100 billion in state and local government debt.

At the end of 2023, the most recent year for which complete data is available, 48 of the 50 states had at least $10 billion in total debt.

Only Vermont ($8.8 billion) and South Dakota ($5.9 billion) had less than $10 billion in state and local debt.

STORY CONTINUES . . .

STORY CONTINUES . . .