Interesting article. Retail is obviously in peril as the economy is reeling from high inflation and high consumer debts.

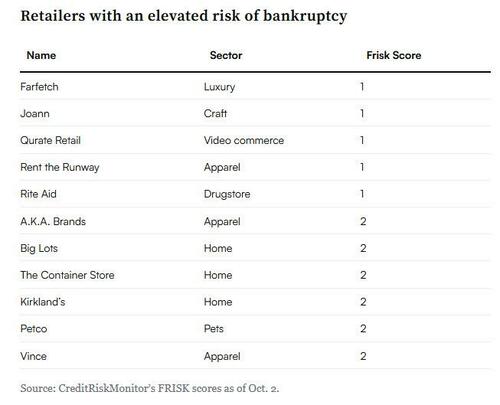

I would not have guessed Petco, I figured their foray into pet grooming and even operating pet clinics on site would guarantee traffic flow. JoAnn Fabric also surprised me, largely because the parking lot is always busy when I pass and because my wife tends to shop there. But she complained the prices are high and only shops with coupons and during sales, so maybe that is when the lot is full?

www.zerohedge.com

www.zerohedge.com

MUCH MORE TO THE STORY at the link above, and it includes details about these various retail chains if you want to dive deep.

I would not have guessed Petco, I figured their foray into pet grooming and even operating pet clinics on site would guarantee traffic flow. JoAnn Fabric also surprised me, largely because the parking lot is always busy when I pass and because my wife tends to shop there. But she complained the prices are high and only shops with coupons and during sales, so maybe that is when the lot is full?

The 11 Retailers Most At Risk Of Bankruptcy In The Next 12 Months | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

MUCH MORE TO THE STORY at the link above, and it includes details about these various retail chains if you want to dive deep.

The 11 Retailers Most At Risk Of Bankruptcy In The Next 12 Months

By Cara Salpini of RetailDive

The first nine months of 2023 have seen big-name retailers including David’s Bridal, Bed Bath & Beyond and Party City file for bankruptcy. And more could be on the way.

Moody’s Investors Service in July said defaults in retail and apparel would continue to rise, jumping from 6% to 8.6% in the following 12 months as weakening consumer spending and high product, labor and freight costs weigh on businesses. And in a Sept. 20 report, S&P Global Ratings warned that the risk of a U.S. recession in the next 12 months, while lower than the start of the year, was still elevated.

“A lot of retail is consumer discretionary so in the event of an economic pullback, or economic uncertainty, you’ll see some of that revenue come down because it’s more of a discretionary purchase,” Elizabeth Han, a senior director on Fitch Ratings’ U.S. leveraged finance team, said in an interview.

Han noted supply chain and inventory challenges, as well as inflation and other macroeconomic concerns have affected retailers as well. Fitch has witnessed more distressed debt exchanges from retailers recently, and Han cited high interest rates as another challenge for companies loaded down with debt.

“There was really no expectation that the velocity of interest rate hikes would be this fast in such a short timeframe. I think there was some sense of, ‘if the Fed is going to raise rates, it won’t even be until next year,’ and then here we are,” Han said. “So I think some companies, they’ve just kind of caught a little bit off guard.”

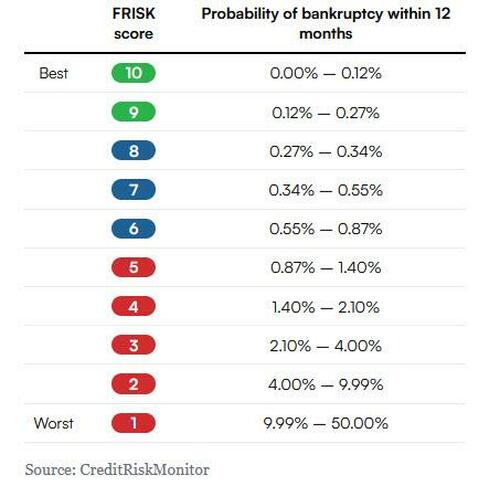

Fitch’s own list of vulnerable retailers includes players like 99 Cents, At Home, Belk, Rugs USA and Joann. CreditRiskMonitor, which labels companies with a FRISK score to measure the probability of them filing for bankruptcy within 12 months, listed 11 noteworthy retailers and brands with either a 4% to 10% chance of filing for bankruptcy or a 10% to 50% chance.

The story of who files and who doesn’t often comes down to debt, according to David Silverman, senior director of Fitch Ratings’ U.S. retail team.

“Abercrombie & Fitch and J. Crew actually had very similar operating stories,” Silverman said. “These are mid-tier, mall-based department store brands that had lost their way a little bit. One ended up undertaking a number of distressed debt exchanges and ultimately filed bankruptcy at the beginning of the pandemic. The other one didn’t really and still doesn’t really have any debt.”

The other difference? “One of them went through an LBO and one of them didn’t,” Silverman said.

The majority of high-profile retail bankruptcies in the past few years have featured a leveraged buyout, Silverman noted, including Neiman Marcus, J. Crew and Toys R Us. And several retailers at risk according to CreditRiskMonitor, or by Fitch’s measure, are either currently owned by private equity or had previous private equity ownership.

Some occupy sectors that seemed to thrive during the pandemic, like home, pets or crafting. Trends that buoyed those sectors are showing signs of reversing, and the boost the pandemic gave some of those businesses may have been simply a “positive interruption” to an otherwise negative trajectory, according to Silverman.

“Some companies that saw this period as a little bit more temporal took the opportunity to say, ‘Look, we’re over-earning, let’s take some cash flow and pay down debt. Let’s clean up the balance sheet,’” Silverman said. “Unfortunately, there were a number of consumer and retail companies that felt like, ‘The strength that we are seeing today is going to continue’ … and they actually made decisions that turned out to be, frankly, regrettable.” . . .