As if we didn't already expect this.

The newest 'CPI' report pretty much shows that inflation is still growing, it has not peaked, and we can probably guess is not close to the peak. My bet is that the commodity bull market is officially starting and the stock/equities market is probably going to collapse along with home sales and prices. The Federal Reserve, in my estimation, is too far behind the curve in raising interest rates, they are starting 6 months too late and now are going to have raise rates fast, which will likely lead us to stagflation or full blown recession. But I'm a pessimist.

FULL Article at ZeroHedge. They have been covering inflation for quite a while, full analysis and updates at the link.

www.zerohedge.com

www.zerohedge.com

The newest 'CPI' report pretty much shows that inflation is still growing, it has not peaked, and we can probably guess is not close to the peak. My bet is that the commodity bull market is officially starting and the stock/equities market is probably going to collapse along with home sales and prices. The Federal Reserve, in my estimation, is too far behind the curve in raising interest rates, they are starting 6 months too late and now are going to have raise rates fast, which will likely lead us to stagflation or full blown recession. But I'm a pessimist.

FULL Article at ZeroHedge. They have been covering inflation for quite a while, full analysis and updates at the link.

Soaring CPI Crushes 'Peak Inflation' Narrative, Sparks Global Market Turmoil | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Soaring CPI Crushes 'Peak Inflation' Narrative, Sparks Global Market Turmoil

No lipstick from talking heads could prettify this pig.

There have only been 2 months in the last two years where CPI has printed less than expected and CPI has risen for 14 straight months (Biden has been president for the last 16). Additionally, sentiment among Americans collapsed to a record low (UMICH) and inflation expectations surged (signaling Fed credibility is plunging), all of which sent the US Macro Surprise index down to its weakest since Aug 2019...

Source: Bloomberg

The reaction was violent... and everywhere.

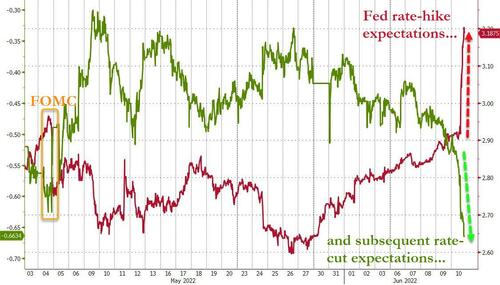

First things first, STIRs exploded with year-end rate-hike expectations soaring by 30bps today alone! And at the same time, the subsequent rate-cut expectations have soared (as The Fed desperately digs America out of recession)...

Source: Bloomberg

The market is now pricing in 10 more rate-hikes by the end of 2022 and then 3 rate-cuts following it.

And it appears to be the latter that sparked a surge in gold to its highest in one month...

But the former sent everything else lower (in price) on the day: US & EU stocks puked, US & EU bond prices plunged US HY bond prices were battered, oil dropped, copper dropped, crypto dropped, banks and big tech were battered.

The US equity market was monkeyhammered in the last two days after early-week attempts at a short-squeeze. Nasdaq was the worst performer, down 5% on the week...

This was the S&P 500 and Nasdaq's worst weekly loss since Jan 2021.

The S&P 500 is down 10 of the last 11 weeks - the worst stretch since the Great Depression...

Source: Bloomberg

Financials were clubbed like a baby seal on the week while Energy stocks tried to get back to even this afternoon but closed red leaving them the prettiest horse in the glue factory...

Source: Bloomberg

VIX spiked back above 28 this week but remains drastically decoupled from credit market risk which is exploding to new cycle highs...

Source: Bloomberg

The last time US HY bond prices were this low, The Fed stepped in to buy them in an unprecedented action

Source: Bloomberg

European stocks were no less hammered (not helped at all by The ECB) with Italy worst...

Source: Bloomberg

European bond markets were a bloodbath as 'fragmentation' fears were not assuaged by ECB's Lagarde and peripheral sovereign spreads spiked...

Source: Bloomberg

Italian yields topped their 2018 highs (highest since 2014), German 10Y yields topped 1.50% for the first time since 2014 and 2Y Gilts spiked above 2.00% for the first time since 2008...

Source: Bloomberg