This will totally upend the big pharma companies and their bottom lines. This could certainly lead to a real cure. It is partial now. It is also groundbreaking for anyone who is dealing with Insulin dependent diabetes.

www.zerohedge.com

www.zerohedge.com

This isn’t just theory. In a clinical trial at Uppsala University in Sweden, Sana’s genetically engineered pancreatic islets were injected into the forearm of a Type 1 diabetic. As the company noted in its annual report, this patient is now more than three months post-treatment, making his own insulin for the first time in 30 years—with no immunosuppressive therapy.

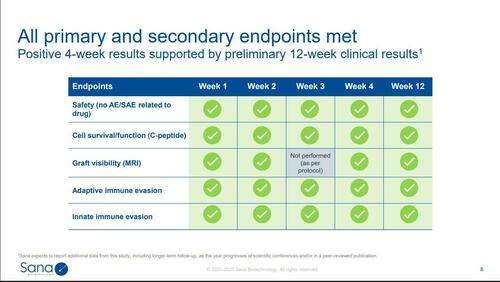

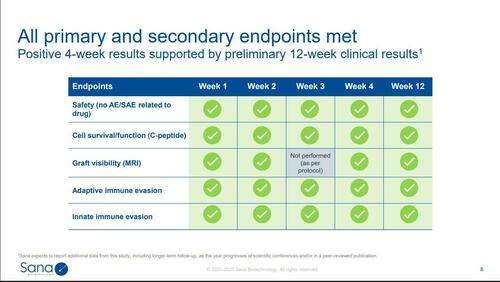

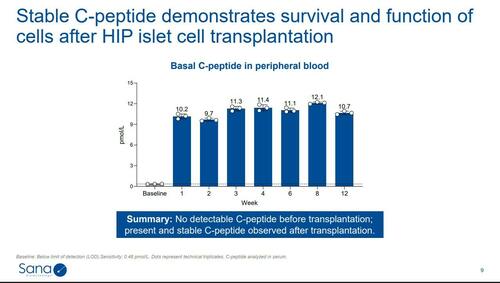

A recent presentation by Sana shows the results of this experiment so far. The C-peptide mentioned there is a biomarker of insulin production.

Slides from Sana’s May 2025 Corporate Presentation.

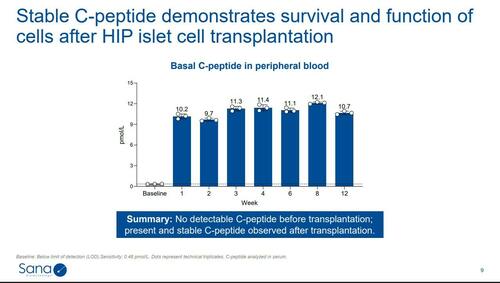

As the subsequent slide in the presentation shows, the patient was producing no insulin before the procedure, but has been producing insulin consistently since.

Larger dose‑escalation cohorts under way, with 6‑ and 12‑month read‑outs expected over the next year.

As you can see above, diabetes therapies comprise 75% of Novo Nordisk’s (NVO 0.00%↑) sales and 43% of Eli Lilly’s (LLY 0.00%↑). For DexCom ( DXCM 0.00%↑ ) and Insulet (PODD 0.00%↑), diabetes is pretty much their entire businesses.

The End Of The T1 Diabetes Industry? | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

The End Of The T1 Diabetes Industry?

A Threat To The Diabetes Cash Cow

Years ago, in a conversation with an endocrinologist, I mentioned there was no incentive to cure diabetes, giving the money companies were making from managing it (with testing supplies, insulin, etc.). He replied that the incumbents had no incentive to cure it, but a startup company would. Now it looks like one has—at least in one patient. Sana Biotechnology (SANA 0.00%↑) has developed a one-time treatment that could upend the entire diabetes industry.How It Works

Type 1 diabetes occurs when the immune system destroys the pancreatic beta cells, which are responsible for producing insulin. While transplants of donor islets—clusters of cells that include beta cells—can restore insulin production, they require scarce donor tissue and lifelong immunosuppressive drugs, which carry serious risks. As a result, insulin remains the only practical treatment for nearly all Type 1 diabetics. Sana has successfully engineered donor-derived islets to evade immune rejection, enabling a Type 1 diabetic to produce his own insulin, without the need for immunosuppressive drugs.This isn’t just theory. In a clinical trial at Uppsala University in Sweden, Sana’s genetically engineered pancreatic islets were injected into the forearm of a Type 1 diabetic. As the company noted in its annual report, this patient is now more than three months post-treatment, making his own insulin for the first time in 30 years—with no immunosuppressive therapy.

A recent presentation by Sana shows the results of this experiment so far. The C-peptide mentioned there is a biomarker of insulin production.

Slides from Sana’s May 2025 Corporate Presentation.

As the subsequent slide in the presentation shows, the patient was producing no insulin before the procedure, but has been producing insulin consistently since.

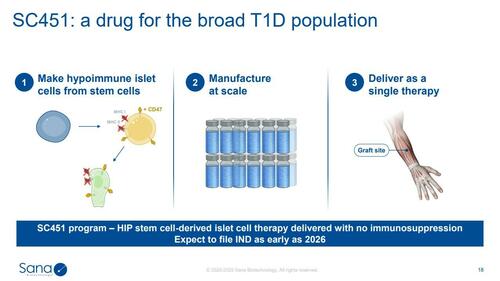

The Plan For Mass Production

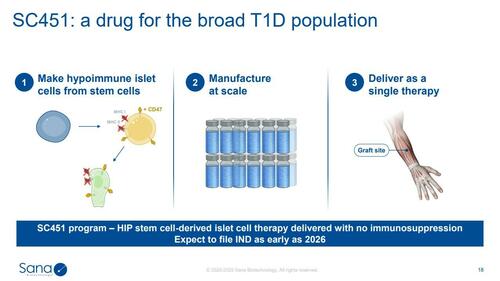

The islet cells used in that trial came from a cadaveric donor. Sana’s goal is to scale this breakthrough using stem cell–derived islets—which contain insulin-producing beta cells—that can be manufactured in large quantities and delivered off the shelf. The result would be a one-time treatment that could eliminate the need for insulin, blood sugar monitoring, and other diabetes therapies.

Larger dose‑escalation cohorts under way, with 6‑ and 12‑month read‑outs expected over the next year.

The Potential Market Impact

If the current results hold up, Sana’s therapy would convert Type‑1 diabetes from a chronic drug‑and‑device market into a one‑time cell‑therapy market—a seismic shift for incumbents.As you can see above, diabetes therapies comprise 75% of Novo Nordisk’s (NVO 0.00%↑) sales and 43% of Eli Lilly’s (LLY 0.00%↑). For DexCom ( DXCM 0.00%↑ ) and Insulet (PODD 0.00%↑), diabetes is pretty much their entire businesses.