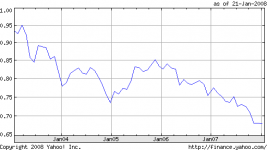

BUY GOLD!! Buy precious metals when the market opens TODAY on the 22nd. We are going into a major recession.

Look, Im not into finance but I AM into common sense. This market will crash and we will be stuck in a HUGE adjustment / recession.

This has been leading up to this point I feel for the last 6 years.

Who is to blame is another topic for another day because Im too tired and I have to get some shut-eye.

Buy precious metals!!!!!!!

Look, Im not into finance but I AM into common sense. This market will crash and we will be stuck in a HUGE adjustment / recession.

This has been leading up to this point I feel for the last 6 years.

Who is to blame is another topic for another day because Im too tired and I have to get some shut-eye.

Buy precious metals!!!!!!!

THE SKY IS FALLING!

THE SKY IS FALLING!