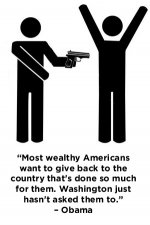

"Rhetorically, Obama defines the 'rich' as millionaires like himself or billionaires like Warren Buffet. But in reality he sets his sights considerably lower: households (and small businesses) that make more than $250,000 a year. As for shared sacrifice, it is hard to find any in his [budget] proposal. Six out of 10 U.S. households receive more from the government than they pay in taxes. If 'shared sacrifice' is the standing order of the day, where is theirs? The president suggests that repealing Bush's tax cuts will save the day. But the vast bulk of those cuts go to people making less than $250,000 a year. The president wants to keep those cuts as his idea while talking about shared sacrifice. Meanwhile, as The Wall Street Journal notes, if you taxed everyone who makes over $100,000 at a rate of 100 percent, you still wouldn't raise enough to balance president Obama's budget, never mind pay off any debt. ... By setting his fortifications so far to the left of the middle ground, he gives the forces of reform room to advance far. The rank and file are ready for battle, with the tea parties at the forefront. The only question is whether the GOP's generals have the stomach for the fight. And that question raises as much dread as hope." --columnist Jonah Goldberg

Re: The Left

"n 2009, Obama took itemized deductions of $514,819, a foreign tax credit of $59,372, and a deduction for interest on his home of $52,195. He was also able to take a deduction for $49,000 he contributed to his self-employed retirement fund. If he had not taken these deductions, he would have paid taxes on an additional $675,386, which in his income bracket would have meant he owed somewhere in the neighborhood of $200,000 more in taxes at the top marginal tax rate of 35 percent. Furthermore, he instructed the Nobel committee to donate his entire $1.4 million Nobel Prize directly to 10 charities, thereby avoiding the necessity of declaring the money as income on which he would have owed an additional $490,000 in taxes. If the president is so appalled at the rich and their ability to hire accountants to take advantage of each and every deduction, why doesn't he simply take the standard deduction on his tax return, like most Americans?" --columnist Linda Chavez

Re: The Left

"n 2009, Obama took itemized deductions of $514,819, a foreign tax credit of $59,372, and a deduction for interest on his home of $52,195. He was also able to take a deduction for $49,000 he contributed to his self-employed retirement fund. If he had not taken these deductions, he would have paid taxes on an additional $675,386, which in his income bracket would have meant he owed somewhere in the neighborhood of $200,000 more in taxes at the top marginal tax rate of 35 percent. Furthermore, he instructed the Nobel committee to donate his entire $1.4 million Nobel Prize directly to 10 charities, thereby avoiding the necessity of declaring the money as income on which he would have owed an additional $490,000 in taxes. If the president is so appalled at the rich and their ability to hire accountants to take advantage of each and every deduction, why doesn't he simply take the standard deduction on his tax return, like most Americans?" --columnist Linda Chavez