Treasury Secretary Steve Mnuchin has unveiled one of the biggest tax cuts in U.S. history this afternoon.

The key points to take away include the following:

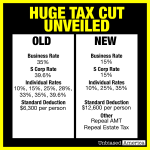

• The business tax rate will be lowered from 35% to 15%, taking the U.S. from one of the highest corporate tax rates in the developed world to one of the lowest.

• The top rate for "S corporations," small organizations that currently file returns under the individual tax code, would fall from 39.6% to 15%.

• End to double taxation on overseas profits.

• A one-time tax on overseas profits coming back to the U.S.

• Individual income tax rates will be reduced to 3 brackets, 10%, 25%, and 35%.

• The standard deduction for individuals and married couples will double, saving families $6,300 per person.

• A married couple will not pay taxes on the first $24,000 of income.

• All deductions other than charity and mortgage interest will be eliminated.

• The marriage penalty would be eliminated.

• Eliminate 3.8% Obamacare Tax.

• Reduce tax on capital gains and dividends back to pre-Obama rates.

• Repeal "Death Tax" on inheritances.

Source #1 => https://www.usatoday.com/story/news...onald-trump-tax-plan-steve-mnuchin/100923518/

Source #2 => http://www.foxbusiness.com/politics...de-large-increase-in-personal-deductions.html

The key points to take away include the following:

• The business tax rate will be lowered from 35% to 15%, taking the U.S. from one of the highest corporate tax rates in the developed world to one of the lowest.

• The top rate for "S corporations," small organizations that currently file returns under the individual tax code, would fall from 39.6% to 15%.

• End to double taxation on overseas profits.

• A one-time tax on overseas profits coming back to the U.S.

• Individual income tax rates will be reduced to 3 brackets, 10%, 25%, and 35%.

• The standard deduction for individuals and married couples will double, saving families $6,300 per person.

• A married couple will not pay taxes on the first $24,000 of income.

• All deductions other than charity and mortgage interest will be eliminated.

• The marriage penalty would be eliminated.

• Eliminate 3.8% Obamacare Tax.

• Reduce tax on capital gains and dividends back to pre-Obama rates.

• Repeal "Death Tax" on inheritances.

Source #1 => https://www.usatoday.com/story/news...onald-trump-tax-plan-steve-mnuchin/100923518/

Source #2 => http://www.foxbusiness.com/politics...de-large-increase-in-personal-deductions.html